The 2014 Assets & Opportunity Scorecard finds that liquid asset poverty rates have barely budged. The percentage of households in the US who lack the savings needed to weather a financial storm like a job loss or medical emergency is holding tight at 44%, suggesting that almost half of Americans are on the brink of financial calamity. The Scorecard also found that problems like growing student loan debt and high rates of consumers with sub-prime credit—especially among households of color—are to blame for Americans’ lingering inability to get ahead and build a more secure financial future for themselves and their families.

Friday, January 31, 2014

Living Paycheck to Paycheck: Nearly 44% of Americans Have Less Than 3 Months' Worth of Savings

Mark Weisbrot on Economic and Social Policy and the Problems of the Eurozone and European Integration

By Mark Weisbrot

It was not because of the power of financial markets or because the Germans didn't want to "help" the Greeks that Europe suffered through about three years of recurring crises, in which the continued existence of the euro was thrown into question, until August 2012. It was because the European authorities were using these acute crises and did not want to resolve them until they had extracted certain "reforms" from the weaker European economies (and possibly even some of the stronger ones, if we consider the European Fiscal Compact and what the French government has been doing recently). We know this because as soon as the European Central Bank (ECB) wanted to do so, it put an end to these crises in a matter of weeks, in July-August 2012, by effectively establishing a ceiling on the interest rates of Italian and Spanish bonds - something it could have done at any time in the prior three years.Read the rest here.

Kevin Gallagher on capital controls in developing countries

From the letters section in the Financial Times.

For the piece Kevin is responding to go here (subscription required)

Palley on why Krugman and other New Keynesians are NOT Keynesians

Yes, while it is true that New Keynesians do agree with Post Keynesians (or classical-Keynesians, in the sense of the Old Classical Political Economy School revived by Sraffa) in many policy propositions, like the need for more stimulus, Tom is absolutely right that they do occupy a position in the policy debates which precludes real Keynesian ideas to become more generally accepted.

For the full video go here.

Gerald Epstein on why the Fed is pushing interest rates higher

The quantitative easing is when the Federal Reserve essentially prints money and then buys Treasury bills and mortgage-backed securities and other things like that. And they've been doing about $85 billion a month and are now tapering--what they call tapering it down to $65 billion a month. And by doing that, they're putting less money and credit into the economy. And when there's less money and credit in the economy, that tends to raise interest rates. And hence you've seen a big shift in financial markets here in the U.S. and all over the world as a result of this expectation that both short-term and long-term interest rates are going to go up.

Wednesday, January 29, 2014

Obama's Minimum Wage Hike Excludes Thousands and Fails to Look at Roots of Income Inequality

It's important that we restore the minimum wage. We're not talking about raising it. We're talking about restoring it. Back in the mid '60s, it was almost $11 an hour. And education is certainly very important and too much neglected in this country. We put huge barriers to bright but poor and middle-class children getting first-rate educations, especially at college. But we have much more fundamental problems than that. Many of these problems involve things like government rules that hardly anybody knows about that take money from the many and redistribute it to the few, the use of tax dollars to build factories, office buildings, and shopping malls, the rules that allow multinational corporations--not domestic, not mom-and-pop corporations, but multinational corporations-- to actually profit off their corporate income taxes by delaying payment of them for 30, 40, 50 years and having you and I let them deposit that money with the government to collect interest while the value of the tax they owe erodes.

How bad is the Argentine crisis?

There is a certain view about current events in Argentina that tends to emphasize the potential effects of the devaluation as the collapse of the economic model, and, and, hence, suggest that the post-default process of economic growth should not be taken as an alternative for other countries in distress, like for example Greece and other Southern European countries. This kind of view, expressed for example by Walter Molano in the Financial Times (subscription required; minus the strange argument that the Argentine problem is "geographical"), suggests that policies should be aimed at pleasing international financial markets since the goal is to promote "confidence in the country’s economic management," and that devaluation is necessary for solving the "unsustainable economic imbalances."

First, it must be understood that the current devaluation, which was of the order of 20% in nominal terms in the last days of last week, is part of a plan that was most likely in the works, since the change in the economic team at the end of last November, when the current finance minister, Axel Kicillof, became the sole commander of the economy displacing Guillermo Moreno, and to a lesser extent Mercedes Marcó del Pont (full disclosure, I worked in the central bank during her tenure as president) in the internal domestic dispute.

In other words, this is not a balance of payments crisis (or a currency one) per se, even though it might become one, since it was actually part of a policy decision, first to accelerate the depreciation of the currency, which started in the last month of 2013 after the new finance minister assumed his position, and that culminated with the renegotiation of the debt with the Paris Club (to regain access to international financial markets), and the gradual liberalization of the exchange market, trying to move the official rate closer to the 'blue,' that is, the black market rate. Note that the current account, as I noted before here, is not in a terrible situation, the Brazilian position has been far worse for a longer period, and the real exchange rate was not more appreciated than in Brazil either.

Before discussing my views of what might happen, it is important to note the New Developmentalist views, which are often associated to Bresser-Pereira and in Argentina to Roberto Frenkel and his co-authors, that the re-alignment of the real exchange rate was inevitable and necessary to promote more competitiveness and growth does not hold water (see my previous critique here, and Fiorito and Amico's here). Bresser has in fact argued that this devaluation is likely to be good for Argentina. In his words (the whole article here):

In my view, the devaluation was not inevitable and is not particularly good. First, it will be inflationary, and as I noted a few years back, also might be contractionary, so expect less growth this year. The reduced growth is what will hold the current account in a reasonable situation, by the way. Hence, devaluation will not solve either the inflationary problem, nor the external constraint one. In this sense, the crisis (manufactured as it is) is worse than most people understand, since it won't solve any of the pressing problems in Argentina.

Note that if the government on top of the current measures adds fiscal contraction (monetary tightening is a given, since higher rates of interest will be needed to avoid more capital flight; and the effects of monetary contraction can be compensated by subsidized public credit) as the New Developmentalists wanted (since for them inflation was caused by excess demand) then the slowdown will be significant and even a recession could take place. The Plan Progresar (that gives money to young students without jobs) might indicate the opposite disposition, but the crisis might force the government to slowdown the economy to avoid a more serious current account deficit.

A more benign scenario would be that the Central Bank manages to control the depreciation, and stabilize the real exchange rate, likely at a somewhat depreciated rate (how much will depend on wage resistance, and how much inflation we get; my guess is that some real depreciation will take place, and lower real wages will follow, which also will add a contractionary force in domestic demand), but this does not turn into a run on the currency.

As I noted before, there are good reasons to believe that lack of growth in advanced economies and low rates of interests in the center will preclude outflows of capital, if higher real rates of interest are imposed in Argentina (they are still negative now) like Brazil has done. Also, the plateau of commodity prices indicates that the balance of payments will not worsen immediately, so there will still be space to solve the long-term problems associated with excessive dependence on the export of commodities, and to pursue the difficult but necessary process of import substitution.

In short, the default and the process of growth (which was possible because of favorable external conditions, but NOT caused just by that; as I noted several times terms of trade improved less in Argentina than in Brazil, and the former grew far more during the commodity boom period), which was based on fiscal expansion and income redistribution is an alternative to Neoliberal policies. And the way to deal with the limits to the model (which are associated to the external constraint) are not related to the exchange rate, but to industrial policy.

PS: Here a video in which Fabián Amico provides a similar analysis (in Spanish).

First, it must be understood that the current devaluation, which was of the order of 20% in nominal terms in the last days of last week, is part of a plan that was most likely in the works, since the change in the economic team at the end of last November, when the current finance minister, Axel Kicillof, became the sole commander of the economy displacing Guillermo Moreno, and to a lesser extent Mercedes Marcó del Pont (full disclosure, I worked in the central bank during her tenure as president) in the internal domestic dispute.

In other words, this is not a balance of payments crisis (or a currency one) per se, even though it might become one, since it was actually part of a policy decision, first to accelerate the depreciation of the currency, which started in the last month of 2013 after the new finance minister assumed his position, and that culminated with the renegotiation of the debt with the Paris Club (to regain access to international financial markets), and the gradual liberalization of the exchange market, trying to move the official rate closer to the 'blue,' that is, the black market rate. Note that the current account, as I noted before here, is not in a terrible situation, the Brazilian position has been far worse for a longer period, and the real exchange rate was not more appreciated than in Brazil either.

Before discussing my views of what might happen, it is important to note the New Developmentalist views, which are often associated to Bresser-Pereira and in Argentina to Roberto Frenkel and his co-authors, that the re-alignment of the real exchange rate was inevitable and necessary to promote more competitiveness and growth does not hold water (see my previous critique here, and Fiorito and Amico's here). Bresser has in fact argued that this devaluation is likely to be good for Argentina. In his words (the whole article here):

"the peso retrieved the lost competitive equilibrium; the government declared that the peso had reached the desired level, and, without fearing an increase in the dollar's official price, it suspended several restrictions to the purchase of dollars , in order to draw the parallel down. If this strategy of keeping the exchange rate at the competitive level is successful, profit expectations will rise, business enterprises will invest again, the current account surplus will be restored, and the Argentinian crisis will be over."Martín Rapetti (a Frenkel co-author) remains more skeptical here (in Spanish), but insists it was inevitable (the exchange rate realignment).

In my view, the devaluation was not inevitable and is not particularly good. First, it will be inflationary, and as I noted a few years back, also might be contractionary, so expect less growth this year. The reduced growth is what will hold the current account in a reasonable situation, by the way. Hence, devaluation will not solve either the inflationary problem, nor the external constraint one. In this sense, the crisis (manufactured as it is) is worse than most people understand, since it won't solve any of the pressing problems in Argentina.

Note that if the government on top of the current measures adds fiscal contraction (monetary tightening is a given, since higher rates of interest will be needed to avoid more capital flight; and the effects of monetary contraction can be compensated by subsidized public credit) as the New Developmentalists wanted (since for them inflation was caused by excess demand) then the slowdown will be significant and even a recession could take place. The Plan Progresar (that gives money to young students without jobs) might indicate the opposite disposition, but the crisis might force the government to slowdown the economy to avoid a more serious current account deficit.

A more benign scenario would be that the Central Bank manages to control the depreciation, and stabilize the real exchange rate, likely at a somewhat depreciated rate (how much will depend on wage resistance, and how much inflation we get; my guess is that some real depreciation will take place, and lower real wages will follow, which also will add a contractionary force in domestic demand), but this does not turn into a run on the currency.

As I noted before, there are good reasons to believe that lack of growth in advanced economies and low rates of interests in the center will preclude outflows of capital, if higher real rates of interest are imposed in Argentina (they are still negative now) like Brazil has done. Also, the plateau of commodity prices indicates that the balance of payments will not worsen immediately, so there will still be space to solve the long-term problems associated with excessive dependence on the export of commodities, and to pursue the difficult but necessary process of import substitution.

In short, the default and the process of growth (which was possible because of favorable external conditions, but NOT caused just by that; as I noted several times terms of trade improved less in Argentina than in Brazil, and the former grew far more during the commodity boom period), which was based on fiscal expansion and income redistribution is an alternative to Neoliberal policies. And the way to deal with the limits to the model (which are associated to the external constraint) are not related to the exchange rate, but to industrial policy.

PS: Here a video in which Fabián Amico provides a similar analysis (in Spanish).

Ernesto Screpanti: Global Imperialism and the Great Crisis - The Uncertain Future of Capitalism

From Monthly Review

In this provocative study, economist Ernesto Screpanti argues that imperialism—far from disappearing or mutating into a benign “globalization”—has in fact entered a new phase, which he terms “global imperialism.” This is a phase defined by multinational firms cut loose from the nation-state framework and free to chase profits over the entire surface of the globe. No longer dependent on nation-states for building a political consensus that accommodates capital accumulation, these firms seek to bend governments to their will and destroy barriers to the free movement of capital. And while military force continues to play an important role in imperial strategy, it is the discipline of the global market that keeps workers in check by pitting them against each other no matter what their national origin. This is a world in which the so-called “labor aristocracies” of the rich nations are demolished, the power of states to enforce checks on capital is sapped, and global firms are free to pursue their monomaniacal quest for profits unfettered by national allegiance.See rest here

Saturday, January 25, 2014

Highly Educated, Highly Indebted: The Lives of Millenials

From The Atlantc:

What's are today's young adults really like? For those who've spent too much time gazing into the dark recesses of Thought Catalog or obsessing over "Girls," the Department of Education has a new report that offers up some enlightening answers. In the spring of 2002, the government's researchers began tracking a group of roughly 15,000 high school sophomores—most of whom would be roughly age 27 today—with the intention of following them through early adulthood. Like myself, many of those students graduated college in 2008, just in time to grab a front-row seat for the collapse of Lehman Brothers and the economic gore fest that ensued. In 2012, the government’s researchers handed their subjects an enormous survey about their lives in the real world. Here, I've pulled together the most interesting findings.Read rest here

Friday, January 24, 2014

State of Power 2014 and Davos Man

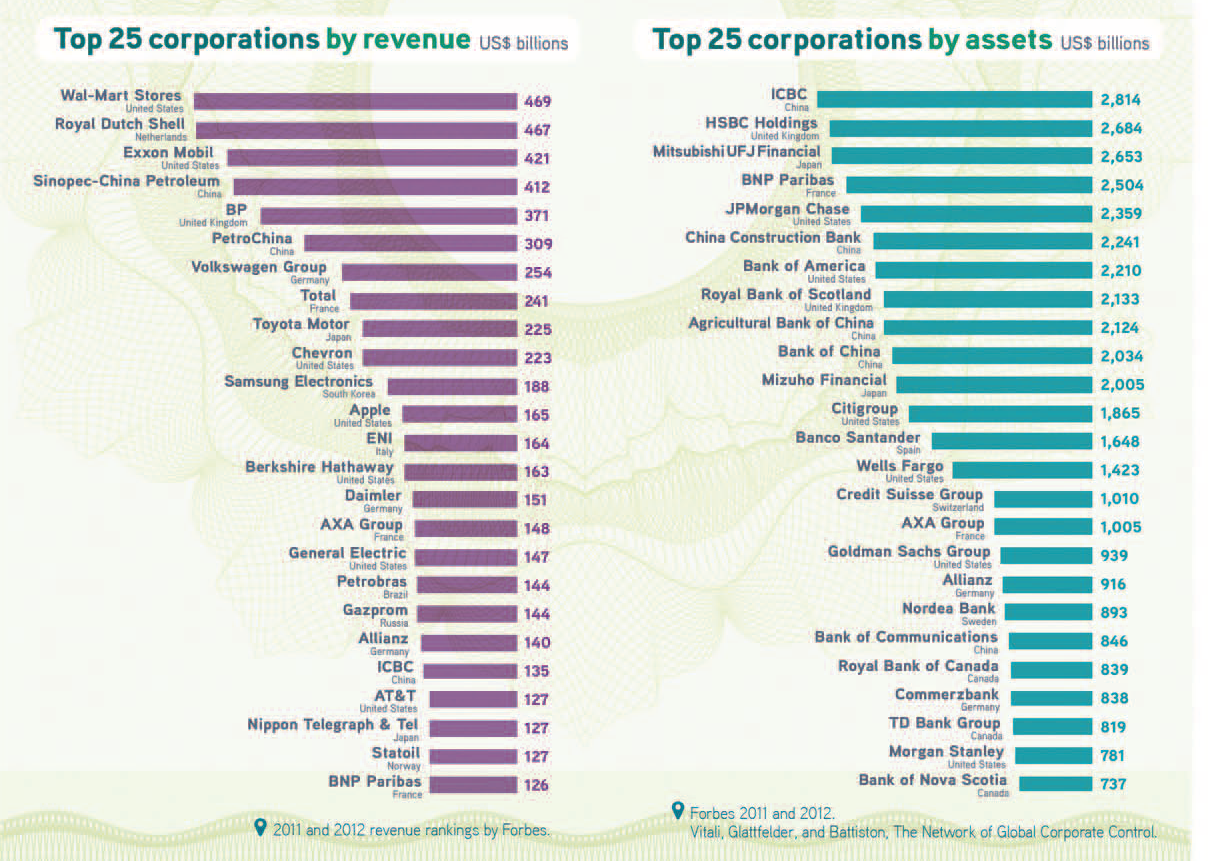

Global elites are meeting in Davos this week. Davos Man is all for 'stakelholder' society, meaning corporate self-rule. New Report State of Power 2014 exposes the abuses of the Davos elites. Above the graph showing the 25 biggest corporations by revenue and by asset value.

Do ideas matter?

By James K Galbraith

First, a preliminary. It is my position, pace the public-choice school and the Marxists, that policy ideas are an independent ideological force.

Some economists, and more political scientists, disbelieve this. Many doubt there exists any role whatever for intellectual persuasion in politics, whether deductive, inductive, or "purely rhetorical." Models, characterized by their attention to the self-interest of bureaucrats and legislators, have been advanced in volume to explain the imperatives of political decision making. If these models are wholly right, then special interests govern all, the scope for discretion and hence persuasion in politics is negligible, and the study of the rhetoric of such discussion can be of only iconological interest.

To be sure, special interests are important. Ulterior motives are endemic in politics. And not all of the scholarly cynicism is misinformed. Council of Economic Advisers Chairman Murray Weidenbaum, when asked directly what weight of influence, on a scale of one to ten, economists had enjoyed in drafting the original tax program of the administration, replied, "Zero."

But special interests do not exhaust the interesting phenomena of politics. There is the opposing view of Keynes on ideas: "the world is ruled by little else." In my experience, ideas and interests interact; neither fully dictates any outcome. Interests are never absent from the discussion and often prevail. But there was always a sense that there was discretion, there were choices, and that the interests occasionally could be outsmarted by ingenuity in rhetoric, including as part of rhetoric various tricks of policy design.

Excerpt from "The grammar of political economy," in The consequences of economic rhetoric, edited by A. Klamer, D. McCloskey, and R. M. Solow.

First, a preliminary. It is my position, pace the public-choice school and the Marxists, that policy ideas are an independent ideological force.

Some economists, and more political scientists, disbelieve this. Many doubt there exists any role whatever for intellectual persuasion in politics, whether deductive, inductive, or "purely rhetorical." Models, characterized by their attention to the self-interest of bureaucrats and legislators, have been advanced in volume to explain the imperatives of political decision making. If these models are wholly right, then special interests govern all, the scope for discretion and hence persuasion in politics is negligible, and the study of the rhetoric of such discussion can be of only iconological interest.

To be sure, special interests are important. Ulterior motives are endemic in politics. And not all of the scholarly cynicism is misinformed. Council of Economic Advisers Chairman Murray Weidenbaum, when asked directly what weight of influence, on a scale of one to ten, economists had enjoyed in drafting the original tax program of the administration, replied, "Zero."

But special interests do not exhaust the interesting phenomena of politics. There is the opposing view of Keynes on ideas: "the world is ruled by little else." In my experience, ideas and interests interact; neither fully dictates any outcome. Interests are never absent from the discussion and often prevail. But there was always a sense that there was discretion, there were choices, and that the interests occasionally could be outsmarted by ingenuity in rhetoric, including as part of rhetoric various tricks of policy design.

Excerpt from "The grammar of political economy," in The consequences of economic rhetoric, edited by A. Klamer, D. McCloskey, and R. M. Solow.

Geoff Schneider on Adam Smith and Karl Marx

Available here the Power Point presentation for Geoff's Principles class on Smith and Marx. For more you can read chapters 2 and 3 in his textbook Introduction to Political Economy (here if you want to buy it).

Thursday, January 23, 2014

Al Campbell: Designing Socialism - Visions, Projections, Models

Edited by Al Campbell

This highly readable volume explores what contemporary models of socialism have to offer for envisioning a better world and developing feasible alternatives to neoliberalism and pervasive inequality. The book is organized around clearly stated questions that capture core issues and debates. Concise contributions from leading thinkers address the theoretical and historical justification for socialism, what a socialist society would look like, how self-interest and the interests of society can be reconciled, the stages and productive forces of socialism, and how socialist growth differs from capitalist growth. Two related book reviews are included. This volume was originally published as a special issue of Science & Society VOLUME 76, NO. 2, APRIL 2012See here.

Wednesday, January 22, 2014

G-24 Policy Brief: Capital Flow Management and the Trans-Pacific Partnership Agreement

The Trans Pacific Partnership (TPP) being negotiated by 12 governments represents an important opportunity for a fresh approach to the treatment of capital flow management measures in trade agreements. Most regional and bilateral free trade agreements (FTAs) and bilateral investment treaties (BITs) enacted in the past two decades have encouraged capital account liberalization based on the view that this policy choice would facilitate more efficient international allocation of resources and spur foreign investment and growth in developing countries. In recent years, however, there has been a major re-thinking on the issue of capital account liberalization. In December 2012, the International Monetary Fund (IMF) issued a new “institutional view” that endorses the regulation of cross-border finance in some circumstances. The IMF also pointed out that many trade and investment treaties do not provide the appropriate level of policy space to regulate cross-border finance when needed. While the IMF’s new position was the outcome of many years of analysis, it was no doubt influenced by the 2008 financial crisis and the fact that a number of governments have used various forms of capital flow management measures (CFMs) in recent years to address financial volatility. The Trans-Pacific Partnership, as the first major trade negotiations since the 2008 crisis, presents an important arena to ensure coherence between current thinking on CFMs, including the IMF’s “new view," and trade and investment agreements.Read rest here.

The Urban Fiscal Crisis as Neoliberal Shock Therapy: A Cartalist Fiscal-Sociological Approach

An article of mine has been posted by The Hampton Institute, A Working-Class Think Tank. From the intro:

My attempt is to suggest that, although laudatory, the neo-Marxist contributions to fiscal sociology put forward by James O'Connor's (2002 [1973]) The Fiscal Crisis of the State and Erik Olin Wright's (1977) Class, Crisis, and the State ultimately fail to accurately explicate the contradictions concerning the logic of capital during times of urban economic duress. I incorporate a dialectically materialist framework that manifests the interconnections between urban governance, capital accumulation and the structure of the state, with an emphasis on what I call a Cartalist sociological approach to money as an institution of social power to make my argument. The empirical backdrop is the United States, and the aim is to reassess the theoretical significance of the so-called 'fiscal crisis of the state' and its effect on the American urban built environment, in order to reconsider the broad historical contingencies that lead to the transformation from the so-called Keynesian managerial metropolis to the 'neoliberal city' (Harvey, 2009). I emphasize that the transformation was more the result of a deliberate policy by the federal government, so as to set in motion a set of institutional rigid social, political, and economic constraints (structural reforms is the euphemism) to enhance the process of rent-seeking, empirically manifested by the process of austerity & gentrification.Read rest here; a preliminary analysis was posted on NK here

Nassif and Feijó on why Brazil doesn't grow since the 1980s

New paper by André Nassif and Carmen Feijó in the Brazilian Journal of Political Economy (Revista de Economia Política). From the abstract:

"The main goal of our paper is to provide analytical arguments to explain why Bra- zil has not been able to restore its long-term capacity for economic growth, especially compared with its economy in the 1950-1979 period (7.3 per cent per year on aver- age) or even with a select number of emerging economies in the 1980-2010 period (6.7 per cent per year on average, against 2.3 per cent per year on average in Brazil in the same period). We build our idea of convention to growth based on the Keynesian concept of convention. For our purposes, this concept could be briefly summarized as the way in which the set of public and private economic decisions related to different objectives, such as how much to produce and invest, how much to charge for products and services, how to finance public and private debt, how to finance research and development, and so on, are indefinitely — or at least until there is no change — carried out by the political, economic and social institutions. This analytical reference can be connected to the Neo-Schumpeterian National Innovation System (NIS) concept, which emphasizes not only institutions associated with science and technol- ogy per se, but also the complex interaction among them and other institutions. In this paper we identify two conventions to long-term growth in the last three decades in Brazil: the liberal and the neo-developmental. We show that the poor performance in the Brazilian economy in terms of real GDP growth from the 1980s on can be explained by a weak coordination between short-term macroeconomic policies and long-term industrial and technological policies. This weak coordination, in turn, can be associated with the prevalence of the liberal convention from the 1990s on, which has emphasized price stabilization to the detriment of a neo-developmental strategy whose primary goal is to sustain higher rates of growth and full employment in Brazil."The whole issue is available here.

Gerald Friedman: The ACA and America’s Health-Care Mess

While it was enacted in 2010 without a single Republican vote, the Patient Protection and Affordable Care Act (ACA), a.k.a. “Obamacare,” was built model first proposed by the conservative Heritage Foundation in the 1990s and implemented by Republican Governor Mitt Romney in Massachusetts in 2006. The ACA extends the public safety net to more of the working poor but otherwise keeps the private health insurance system intact. Rather than replacing the private system—and far from the “government takeover of health care” its critics claim—it provides subsidies for individuals to buy private health insurance through state-level “exchanges.”Read rest here

Tuesday, January 21, 2014

Felipe & McCombie: The Aggregate Production Function And The Measurement Of Technical Change

In a recent post, see here, it was explicated that TFP only leads to confusion in mainstream analysis

of economic growth. Jesus Felipe & John S.L. McCombie's new book provides an invaluable extensive analysis of the issue at hand.

Felipe and McCombie have gathered all of the compelling arguments denying the existence of aggregate production functions and showing that econometric estimates based on these fail to measure what they purport to quantify: they are artefacts. Their critique, which ought to be read by any economist doing empirical work, is destructive of nearly all that is important to mainstream economics: NAIRU and potential output measures, measures of wage elasticities, of output elasticities and of total factor productivity growth. – Marc Lavoie, University of Ottawa, CanadaSee here

Lord Keynes' List of Heterodox Blogs

Available here. A useful list of blogs, and other pages, for those interested in Post Keynesian, Modern Monetary Theory and other Heterodox discussions in economics.

Monday, January 20, 2014

Total Factor Productivity does NOT measure what you think it does

The conventional discussion of Total Factor Productivity (TFP) starts from a production function. For that reason most people when they hear about the problems with TFP, think that it refers to aggregation problems (which on top many confuse with the capital debates, which did involve a critique of the production function, but was about more than that).

The problem is that TFP is NOT productivity at all. So start from a Cobb-Douglas production function (it doesn’t really matter what production function for our argument):

Log-linearizing and deriving with respect to time you obtain:

Where alpha is the share of wages in national income. Solow suggested that the residual (dA/A) must be the combined effect of the increase in productivity of all factors of production (TFP).

Now consider the income identity that by definition tells us that net income (net of taxes) is composed by the remuneration of capital and labor. We have:

There is no need here to be concerned with aggregation questions. This is an identity and the data reflects NOT a theoretical construct, like the production function, but a national accounting identity.

The total derivative of the identity would be:

Diving by Y, and with some manipulation, knowing that r=R/K, we get:

Note that the first two terms can be re-written using the above notation for the shares of profits (R) and wages (wN) in total income. We have:

Note any similarity with the growth accounting equation? The Solow residual is basically a weighted average of the rate of growth of profits and wages. This is what is being measured, since the data actually comes from the identity, not an imaginary production function. Even if you had a production function, you still would be measuring the identity.

Jesus Felipe and John McCombie have done extensive work, building on the work of Franklin Fisher, Herbert Simon, Anwar Shaikh and others. The use of TFP, when the evident measure of productivity should be labor productivity, only leads to additional confusion in mainstream analysis of economic growth (the other big problem being the supply constraint and the notion of a natural rate).

PS: There are several papers that one should read on (subscrirequired), but I suggest the following one (subscription required) by Felipe and McCombie that shows the kind of confusion that using TFP leads to when applied to the interpretation of the East Asian growth experience.

Polly Cleveland: What’s Crippling the Recovery–Lack of Investment Demand or Too-Big-to-Lend Banks?

By Polly Cleveland

Under incoming Federal Reserve Chair Janet Yellen, the United States Federal Reserve Bank will begin to “taper” its program of “Quantitative Easing” or “QE”. Under QE, the Fed every month buys billions of U.S. Treasury bonds and other Federal securities from the big banks. QE keeps down longer-term interest rates, which will, it is hoped, encourage investment and stimulate the economy. QE has indeed supplied the biggest banks with cheap money for profitable trading in the international financial markets, enabling them to recover from the 2008 crisis—and continue paying big bonuses. It has in fact kept interest rates near zero for big banks and corporations. By purchasing bonds from the “government-sponsored enterprises”, Fannie Mae and Freddie Mac, which buy high-quality mortgages, QE has kept mortgage rates down and hence values up for prime real estate. That’s nice if you qualify, or if you’re a bank holding real estate collateral. By keeping bond yields very low, QE has also sent investors piling into the stock market looking for better returns, creating a stock market boom—nice if you own or issue stocks. So QE has done quite well for big bank executives and other members of the One Percent.Read the rest here

The Economic Policy Institute on the Unfinished March

An EPI Report that is worth reading on the incomplete economic goals of the civil rights movement . From the intro:

"On August 28, 1963, more than 250,000 people participated in the March on Washington for Jobs and Freedom. They marched for equal access to public accommodations, voting rights, and the end of racial discrimination in employment. While achieving the full measure of these rights remains a work-in-progress, legislative and policy commitments to these goals were secured. But the marchers also demanded the following:

Fifty years later, on all socioeconomic measures, African Americans still lag whites by wide margins. At the same time, economic opportunities are shrinking for working people of all races. Until we achieve all of the march’s goals, there is little hope for reducing black-white socioeconomic disparities and providing genuine opportunity for economic advancement to all Americans."

- decent housing

- adequate and integrated education

- jobs for all

- a minimum wage worth more than $13 an hour today

Read the rest here.

Yanis Varoufakis on why Reinhart and Rogoff are wrong about the Eurozone’s debt

By Yanis Varoufakis

Read the rest here.

"Carmen Reinhart and Kenneth Rogoff recently published a notable IMF working paper (13/266) entitled ‘Financial and Sovereign Debt Crises: Some lessons learned and those forgotten’ (December 2013). Their overarching claim is that the advanced economies are wrong to pretend that the present levels of debt can be sustained by means of fiscal austerity and without debt restructuring, sustained inflation or a combination of the two. This is a sensible argument, well grounded on empirical and historical evidence, that governments would be wise to internalise.

However, while the general thrust of the Reinhart and Rogoff paper is indeed reasonable and in principle useful, their discussion of Eurozone debt crisis is founded on a factual error that, since 2010, has been underpinning erroneous policy responses to the Euro Crisis."

Read the rest here.

Sunday, January 19, 2014

Mark Weisbrot: Why the European Economy Has Done So Much Worse Than That of the United States

By Mark Weisbrot,

If we compare the economic recovery of the United States since the Great Recession with that of Europe – or more specifically the eurozone countries – the differences are striking, and instructive. The U.S. recession technically lasted about a year and a half – from December 2007 to June 2009. (Of course, for America’s 20.3 million unemployed and underemployed, and millions of others, the recession never ended – but more on that below.) The eurozone had a similar-length recession from about January 2008 to April 2009; but then it fell into a longer recession in the third quarter of 2011 that lasted for about another two years; it may be exiting that recession currently.Read the rest here.

Can Genetically Modified crops improve food security?

You have to remember that corporations, like Monsanto, are certainly NOT in the business of providing food security. But on the other hand, it is also important not to forget that without genetic manipulation the Green Revolution would not have been possible. In fact, certain crops (like corn, shown above) would not even exist.

The documentary below provides avery skeptical view of GM crops and their role in economic development.

The guy in the documentary, Jimmy Doherty is an advocate of what they term sustainable farming, and while he is not for the use of GM crops he is not completely against them. In my view, progressives have been unable to untangle their dislike for corporations use of GM crops to further their power, with their anti-GM stance.

The documentary below provides a

Saturday, January 18, 2014

World Bank thinks contraction in developing countries is good

The World Bank suggests that the slowdown in the periphery is good, since it has moved several countries from a positive output gap, with excess demand, to sustainable positions with negative output gaps, as shown in the graph below (h/t Otaviano Canuto; source here).

Note that Brazil, China, and India are in this category. Argentina still has excess demand. Potential GDP, which given Okun's Law imply a certain level of unemployment and connect the concept with the other neoclassical standard assumption of a natural rate of unemployment, are quite low in many developing countries if you believe the World Bank.

These are, in the World Bank's view, of course, supply side constraints that are not affected in any way by demand forces, even if the evidence in favor of the accelerator, which suggests that capacity adjusts to demand, is overwhelming.

Note that Brazil, China, and India are in this category. Argentina still has excess demand. Potential GDP, which given Okun's Law imply a certain level of unemployment and connect the concept with the other neoclassical standard assumption of a natural rate of unemployment, are quite low in many developing countries if you believe the World Bank.

These are, in the World Bank's view, of course, supply side constraints that are not affected in any way by demand forces, even if the evidence in favor of the accelerator, which suggests that capacity adjusts to demand, is overwhelming.

Sunanda Sen on financial integration and national autonomy in China and India

Also in the new issue of ROKE. From the abstract:

The narrative as well as the analysis of deregulated finance in the global economy remain incomplete unless one relates to the surges as well as volatility in capital flows which are experienced by the emerging economies. An analysis as above needs to consider the implications of capital flows in those economies, especially in terms of the ‘impossibility’ of adopting monetary policies which benefit growth in the national economy. There is also a need to recognise the role of uncertainty and the related changes in market expectations in the (precautionary) accumulations of the large official reserves as are held by these countries. The consequences are found to affect the fabric of growth and distribution in these economies. Recent experiences of China and India, with their deregulated financial sectors, bear this out.

Financial integration and free capital mobility, which are supposed to generate growth with stability in terms of the ‘efficient markets’ hypothesis, have failed, and not only in the advanced economies but also in the high-growth developing economies like India and China. Deregulated finance has led these countries to a state of compliance, where domestic goals of stability and development are sacrificed to make way for the globally sanctioned norms relating to free capital flows.

With the global financial crisis and the spectre of recession haunting most advanced economies, issues as above in the high-growth economies in Asia have drawn much less attention than they deserve. This oversight leaves the analysis incomplete by ignoring the structural changes that result in these developing economies — which are of much relevance to the pattern of financialisation and turbulence in the global economy as a whole.Whole paper available here.

Friday, January 17, 2014

Wednesday, January 15, 2014

Bernard, Gervorkyan, Palley, Semmler: A Review & Critique of Long Wave Theories

In a previous post (see here), I had argued that the capitalist world economy can be conceived as resting on the dependence of historically-specific hegemonic institutions, whose rise and fall follow the trajectory of long waves, what Giovanni Arrighi defined as systemic cycles of accumulation (SCA's), periods of approximately 40-60 years, separated by A phases and B phases (see here). Lucas Bernard, Aleksandr V. Gervorkyan, Thomas I. Palley, and Willi Semmler, however, offer a penetrating critique of this central tenant of the world-systems tradition.

From the abstract:

From the abstract:

This paper explores long wave theory, including Kondratieff’s theory of cycles inRead rest here.

production and relative prices; Kuznets’ theory of cycles arising from

infrastructure investments; Schumpeter`s theory of cycles due to waves of

technological innovation; Goodwin`s theory of cyclical growth based on

employment and wage share dynamics; Keynes – Kaldor – Kalecki demand and

investment oriented theories of cycles; and Minsky’s financial instability

hypothesis whereby capitalist economies show a genetic propensity to boom-bust

cycles. This literature has been out of favor for many years but recent

developments suggest a reexamination is warranted and timely.

China and Latin American Development

Here are the highlights of the China-Latin America Economic Bulletin published by the Pardee Center and written by Rebecca Ray and Kevin P. Gallagher.

• LAC exports to China have soared since 2000, but slowed in 2012, stalling to a 7.2 percent growth rate in real dollar terms, compared to average annual export growth to China at 23 percent from 2006 to 2011.Read the whole report here.

• Behind this slowdown are falling commodity prices. LAC exporters are “running in place” as exports to China have continued to grow in volume, but have fallen in price, leading to stagnant total export values.

• More than half of all LAC exports remain concentrated in three broad sectors related to copper, iron, and soy—with the majority of these exports concentrated in three countries: Brazil, Argentina, and Chile. These sectors are all prone to large price swings, contributing further to the slowdown in the value of exports to China.

• Chinese exports to LAC are diverse and mostly in manufacturing, with a heavy emphasis on electronics and vehicles. Their value has grown more quickly than LAC exports to China, opening an LAC trade deficit in goods with China in 2011 and 2012.

• Chinese FDI to LAC increased slightly but remains a relatively small percent of total FDI into LAC. Chinese FDI continues to be concentrated in a handful of sectors, such as food and tobacco, automobiles, energy and communications.

• Chinese finance to sovereign governments has slowed and become more discretionary in nature, rather than earmarked for particular industries and sectors.

• Based on preliminary commodity price values for 2013 and projections for 2014, it is reasonable to expect a growing LAC trade deficit in goods with China.

The super-cycle of commodities is NOT over, it's just not super anymore

Or at least is what The Economist says (here). Graph below shows a very long series for commodity prices.

Note that the cycle (super or not) is less visible than the trend (hints of Prebisch-Singer). At any rate, the fall in 2009 and the recovery and then slow fall after 2011 imply that the overall index is now higher than at the lowest point in the series, the late 1990s, and around the same place it was in the early 1950s.

Note that the cycle (super or not) is less visible than the trend (hints of Prebisch-Singer). At any rate, the fall in 2009 and the recovery and then slow fall after 2011 imply that the overall index is now higher than at the lowest point in the series, the late 1990s, and around the same place it was in the early 1950s.

Gary Dymski on the financial crisis and the crisis in economics

In the new issue of the Review of Keynesian Economics (ROKE) you can read Gary's paper (here). From the abstract:

A crisis that started as a textbook case of how financial and asset markets can spin out of control without adequate public oversight has transmuted in 5 years into a crisis of irresponsible sovereigns, such that restoring prosperity requires that governments re-establish control over their own excessive spending. How did this happen? This paper explains the recovery of position by pro-market, restricted-government proponents in economics on the basis of political divides and segmented lines of communication within the academic economics profession. These political divides involve a double invisibilization of power within economics: an invisibilization both of the political purposes served by a profession whose leading models deny the relevance of social and political power, and of the ideational barriers to entry into ‘mainstream’ departments. The argument is motivated and illustrated by the cases of the subprime and the eurozone crises.For those heterodox economists interested in what to do, Gary suggests a pluralistic approach within the various heterodox perspectives.

Tuesday, January 14, 2014

Mexico: Twenty Years of NAFTA Regret

By Mark Weisbrot

It was 20 years ago that the North American Free Trade Agreement between the US, Canada, and Mexico was implemented. In Washington, the date coincided with an outbreak of the bacteria cryptosporidium in the city's water supply, with residents having to boil their water before drinking it. The joke in town was, "See what happens, NAFTA takes effect and you can't drink the water here."But what about Mexico? Didn’t Mexico at least benefit from the agreement? Well if we look at the past 20 years, it’s not a pretty picture. The most basic measure of economic progress, especially for a developing country like Mexico, is the growth of income (or GDP) per person. Out of 20 Latin American countries (South and Central America plus Mexico), Mexico ranks 18, with growth of less than 1 percent annually since 1994. It is of course possible to argue that Mexico would have done even worse without NAFTA, but then the question would be, why?Read the rest here.

EPI: Raising the Federal Minimum Wage Would Lift Wages for Millions and Provide a Modest Economic Boost

At a briefing at the Economic Policy Institute on Tuesday, January 14, 2014, Jason Furman (Chairman of the White House Council of Economic Advisers), Sen. Tom Harkin (D-Iowa), Rep. George Miller (D-Calif.) and Lawrence Mishel of the EPI discussed the economic case for raising the federal minimum wage and the path forward to enact the Fair Minimum Wage Act of 2013.

EPI research shows (see here) the Harkin-Miller bill would give a raise to 27.8 million workers, who would receive about $35 billion in additional wages. A $10.10 minimum wage would increase GDP by $22 billion, creating roughly 85,000 new jobs.

Mind you, raising the federal minimum wage to $10.10 is meager...should be at at least $20.00, which would provide more than just a 'modest boost' to the US economy.

George Stigler and the labor theory of value

George Stigler, author of the famous The Theory of Price, winner of the Sveriges Riksbank Prize (aka the Nobel) and Friedman's best friend at Chicago, suggested long ago that: "the professional study of economics makes one politically conservative." His reasons for that particular view are extensive, but one factor was associated with the decline of the dominance of the labor theory of value and the rise of the supply and demand (marginalist) approach, that he embraced. In his words:

Also, the capital debates led to the conclusion (admitted by Samuelson) that the neoclassical (marginalist) theory was unable to show that relative scarcity determined relative prices and income distribution. In other words, while it is possible to hold a version of the labor theory of value, at least the Smithian labor commanded (in terms of the standard commodity, as suggested by Sraffa), it is not possible to say that supply and demand explain value and distribution.

So Stigler got it all backwards. We are left with the alternative that radical young economists have a hard time finding desirable university posts for purely ideological reasons. Actually lack of honesty and/or intelligence might be an asset rather than a handicap in the economic profession.

"It could be argued that there is one powerful factor making for conservatism: the inability of a very radical young economist to get a desirable university post. It is indeed true that a believer in the labor theory of value could not get a professorship at a major American university, although the reason would be that the professors could not bring themselves to believe that he was both honest and intelligent, and I hope they are not improper in their demand that a professor be at least tolerably honest and presumptively intelligent."Funny thing is that the following year a little monograph was published that demonstrated that the basic propositions of the labor theory of value could be retained. By using the device of the standard commodity, Sraffa reveals that the profit rate can be determined as a physical ratio independently from relative prices, and that the rate of profit is determined by the objective conditions of production and the need of reproducing the system (for more on the standard commodity go here).

Also, the capital debates led to the conclusion (admitted by Samuelson) that the neoclassical (marginalist) theory was unable to show that relative scarcity determined relative prices and income distribution. In other words, while it is possible to hold a version of the labor theory of value, at least the Smithian labor commanded (in terms of the standard commodity, as suggested by Sraffa), it is not possible to say that supply and demand explain value and distribution.

So Stigler got it all backwards. We are left with the alternative that radical young economists have a hard time finding desirable university posts for purely ideological reasons. Actually lack of honesty and/or intelligence might be an asset rather than a handicap in the economic profession.

Monday, January 13, 2014

The Privatization of Public Education in America

By Ann Robertson and Bill Leumer

Obama’s contribution to the privatization campaign has centered for the most part on education. But before we can evaluate its impact, it is necessary to consider the different forms privatization can take in relation to schools, since it can occupy different positions on a wide spectrum of possibilities. At one end of the spectrum lie completely privatized schools that provide their own financing and govern themselves. But many schools are more like hybrids, a mixture of private and public. Charter schools, whose numbers are growing rapidly, are funded with public money (that previously would have gone to public schools) but are privately operated. Often they are run by for-profit or non-profit national companies, as opposed to simply a group of teachers who want to break away from traditional schools and experiment with an alternative curriculum. Similarly, essentially public universities or K-12 schools might make use of online courses produced by private, for-profit companies, and, of course, private companies produce textbooks. Another hybrid example is where public universities have aggressively raised tuition fees at public universities so that funding shifts from the public coffers to the students themselves as private citizens. At the University of California at Berkeley students now contribute more for their education than the state does. In the 1960s the state paid for the vast majority of their expenses. Still another example is where a publicly funded and operated school imports the corporate culture from the private sector. For example, many public universities are abandoning their former practice of promoting faculty into administrative positions, paying them only slightly more than before and, instead, are drawing on administrators from the private sector and paying them exorbitant salaries while paying part-time faculty less than a living wage. Some presidents of public universities now make over $1 million a year. Under such circumstances democratic institutions of shared governance are dismantled while power tends to be concentrated at the top, thereby destroying any spirit of collegiality.Read rest here.

Sunday, January 12, 2014

Two Transitions in Brazil: Dilemmas of a Neoliberal Democracy

By Alfredo Saad Filho

The mass movements starting in June 2013 were the largest and most significant protests in Brazil in a generation, and they have shaken up the country's political system. Their explosive growth, size and extraordinary reach caught everyone – the left, the right, and the government – by surprise. This article examines these movements in light of the achievements and shortcomings of the democratic transition, in the mid-1980s, and the experience of the federal administrations led by the Workers’ Party since 2003.

Read the rest here.

PS: If you read in Portuguese, an alternative explanation of the protests, by Marcos Nobre, is available here.

The mass movements starting in June 2013 were the largest and most significant protests in Brazil in a generation, and they have shaken up the country's political system. Their explosive growth, size and extraordinary reach caught everyone – the left, the right, and the government – by surprise. This article examines these movements in light of the achievements and shortcomings of the democratic transition, in the mid-1980s, and the experience of the federal administrations led by the Workers’ Party since 2003.

Read the rest here.

PS: If you read in Portuguese, an alternative explanation of the protests, by Marcos Nobre, is available here.

Honduras Since the Coup: Economic and Social Outcomes

By Jake Johnston and Stephan Lefebvre of CEPR. From the abstract:

This paper presents a broad overview of economic and social trends in Honduras since 2006, including the years following the military coup of June 2009. It finds that economic inequality in Honduras has increased dramatically since 2010, while poverty has worsened, unemployment has increased and underemployment has risen sharply, with many more workers receiving less than the minimum wage. While some of the decline was initially due to the global recession that began in 2008, much of it is a result of policy choices, including a decrease in social spending.Read rest here.

Saturday, January 11, 2014

Money as debt: a documentary

Friday, January 10, 2014

Sluggish labor market recovery continues

The economy added just 74,000 jobs in December, and the unemployment rate fell to 6.7%, according to the Bureau of Labor Statistics (BLS). In other words, the labor market situation is still pretty bad. Yes the unemployment rate declined during 2013, but in part it resulted from the fact that the labor force participation rate declined by

0.8% point over the year, that is less people trying to find work.

The figure shows how the current recovery looks weak, in particular when compared to the 1990s one, and why it has been insufficient to deal with a more profound crisis (as can also be seen in the figure when compared to the milder collapse of the dot-com bubble).

The figure shows how the current recovery looks weak, in particular when compared to the 1990s one, and why it has been insufficient to deal with a more profound crisis (as can also be seen in the figure when compared to the milder collapse of the dot-com bubble).

Thursday, January 9, 2014

Ideology, Sociology of Knowledge, and the Historic Moment of Production

In the 1920s, the concept of ideology passed through another transformation in its quest for meaning. Karl Mannheim (1893-1947), a Hungarian-born sociologist, took on the project of developing a “sociology of knowledge.” He directly engaged the subject of ideology as articulated by Marx in hopes of developing an objective, yet interpretative, social science approach to the study of ideas. In his quest to understand “the social and activist roots of thinking” (1936: 4), he hoped to develop a theory of ideology that would guide political action and practice. He resituated de Tracy’s “science of ideas” from the domain of the natural sciences to that of sociology. As an advocate of the social science approach to understanding, he advanced a structuralist view of ideology. He theorized a distinction between “particular” and “total” ideologies. Under this framework, particular ideologies were characterized by distortion and fabrications—the intentional misrepresentation of ideas by individuals. Total ideology was thought of as the whole structure of the mind, a product of the social-historical epoch of a class or group derived from material conditions. Mannheim’s total ideology sought to engulf not only ideas and their origin but also analytic methods into the concept of ideology. In this scheme the scientist’s science and the Marxist critique of ideology were considered products of the epoch.

Mannheim’s schema of distinctions, however, became intellectually problematic because it eroded into an extreme relativism. If all ideologies were created from the same historical and social forces and all forms of analyzing ideology are subject to these same forces, then how can one make an analytic judgment? Evaluation becomes impossible. A side affect of this relativist way of thinking about ideology was the eradication of the aspect of domination made explicit in the Marxist critique of ideology. While Mannheim developed yet another duality to address the relativism issue, it was never satisfactorily resolved.

The following points can summarize the brief history of the meaning of ideology:

- Ideology was initially thought of as the scientific study of ideas. It was thought that ideas could be subjected to the same forms of analysis that predominated in the natural sciences.

- While ideology had political consequences it did not initially carry negative connotations until it was used as a label to silence political critics.

- Ideology had an oppositional character because it stood as an alternative philosophy of understanding and way of explaining social and historical change.

- Ideology took on its critical connotation when it was used as a term of opposition to develop a theory rather than a philosophy of historical change.

- Selective reading of critical theory obscured ideology’s dialectical nature, overemphasized its materialistic basis, and focused on the concept as an intentional distort of reality.

- Reformulation of ideology under the “sociology of knowledge” crystallized its distortion aspect and attempted to engulf the critical theory as an unexceptional case. The domination feature of ideology illuminated by critical theory was replaced by a privileged disciplinary view of the concept. Ideology masqueraded as a self-critical and apolitical “science of ideas.”

The negative connotation of ideology is used to characterize thoughts and positions that oppose prevailing views. The negative use of the term implies that ideology is something less than factual or scientific—an intentionally created illusion based on distortion. Contemporary construction of ideology implies that there is some alternative basis from which we can speak; some factual world distinct from the interplay of the material and mental. Yet, the presentation of selected facts, the differential weight given to some facts, and the values generated from what we perceive facts all flow from highly selective choices about how we see and represent reality— in other words from ideology. Regardless of our values, when most people speak they are speaking from and sustaining a particular ideological order.Originally posted here.

New Book By Baker & Bernstein: Getting Back to Full Employment - A Better Bargain for Working People

By Dean Baker and Jared Bernstein

From the Introduction:

From the Introduction:

A strong labor market with full employment need not be a rare economic anomaly that returns roughly twice for every one appearance of Halley’s Comet. Full employment can be a regular feature of the policy landscape, with tremendous benefits for rising living standards, poverty reduction, the federal budget, and equitable economic growth. In this book we present the benefits and importance of full employment in ways that are particularly germane to the economy today, and we offer policies to begin moving to full employment now. Full employment can be defined as the level of employment at which additional demand in the economy will not create more employment. All workers who seek a job have one, they are working for as many hours as they want to or can, and they are receiving a wage that is broadly consistent with their productivity.Full PDF here.

Wednesday, January 8, 2014

Oskar Lange theory of interest and the ISLM

By Roberto Lampa (Guest blogger)

In two previous posts, dated 2011 and 2013, Matías Vernengo clarified that the ISLM model can accommodate changes that incorporate the criticisms of several heterodox groups. In particular, he stresses that the ISLM can accommodate an investment function in which the level of activity (rather than the rate of interest) is central, so that the accelerator can be incorporated. More importantly, he also states the ISLM does not imply a natural rate of unemployment, thus allowing for relevant discussion of policy issues.

Both these aspects can be found in Oskar Lange's 1938 contribution to the neoclassical synthesis, in which he assumes that investment (mostly) depends on consumption, which in turn is permanently distorted by the “irrational” distribution of income, typical of any capitalist economy. More precisely, Lange outlines the mutual dependence of investment and consumption as a sort of ‘indirect’ relationship.

Firstly, he states that, as in traditional theory, in his model an increase in the propensity to save induces a decrease in the rate of interest. However, his reasoning runs along more unconventional lines than the (Neo)-Classical interaction of both supply (of) and demand (for) capital curves:

Not coincidentally, Lange explicitly assumes in equation (3) – by drawing on Karl Marx's realization crisis – that consumption directly affects investment, as an excessive growth in saving (i.e. an excessive contraction of consumption, investment and total income) cannot be counter-balanced by the subsequent decrease in the rate of interest, as it destroys any incentive to invest, "at least in a capitalist economy where investment is done for profit" (Lange, 1938, p.23). He thus firmly rejects the (Neo)-Classical assumption that any abstinence from consumption implies automatically an increase in investment: according to him, such a direct relationship holds only until a certain limit (i.e. the optimum propensity to consume), beyond which the collapse of the demand for investment goods will drastically diminish investment itself. Therefore, the real issue becomes if and how it is possible to determine (and to maintain) such an optimum propensity to consume, given a market economy. Lange's opinion is definitely non-optimistic:

Recently, I have published a detailed analysis of this rather obscure work in the Cambridge Journal of Economics. I explore in depth Lange's theory of interest and its tortuous relationship with both Keynes’ General Theory

(1936) and Hicks' synthesis (1937), developing two graphical models

that show the non-linearity of Lange's investment function as well as

the consequences of his equilibrium solution. Through an unedited

manuscript, I also reconstruct Lange's beliefs about the chronic

sub-optimality of the capitalist economy and his scientific endorsement

of the socialist economy.

Full paper is available here.

P.S. It is worth noting that Keynes himself was prompted to reflect that Lange's article "follows very closely and accurately my line of thought" (Keynes, 1973a) notwithstanding the analytical differences. Lange was, after all, standing on the same "side of the gulf," as he clearly rejected the notion that capitalism could be a "self-adjusting system" (Keynes, 1973b).

In two previous posts, dated 2011 and 2013, Matías Vernengo clarified that the ISLM model can accommodate changes that incorporate the criticisms of several heterodox groups. In particular, he stresses that the ISLM can accommodate an investment function in which the level of activity (rather than the rate of interest) is central, so that the accelerator can be incorporated. More importantly, he also states the ISLM does not imply a natural rate of unemployment, thus allowing for relevant discussion of policy issues.

Both these aspects can be found in Oskar Lange's 1938 contribution to the neoclassical synthesis, in which he assumes that investment (mostly) depends on consumption, which in turn is permanently distorted by the “irrational” distribution of income, typical of any capitalist economy. More precisely, Lange outlines the mutual dependence of investment and consumption as a sort of ‘indirect’ relationship.

Firstly, he states that, as in traditional theory, in his model an increase in the propensity to save induces a decrease in the rate of interest. However, his reasoning runs along more unconventional lines than the (Neo)-Classical interaction of both supply (of) and demand (for) capital curves:

"…an increase in the propensity to save [implies that] expenditure on consumption is now lower. This causes (…) a lower quantity of investment (…). Total income decreases (…). The consequence is a fall in the rate of interest." (pp. 17-18)In other words, in Lange's view the immediate effects of an increase in the propensity to save are a decrease in consumption, investment and total income. Therefore, as recognized by Keynes himself:

"The analysis which I gave in my General Theory of Employment is the same as the ‘general theory’ explained by Dr. Lange on p.18 of his article, except that my analysis is not based (as I think his is in this passage) on the assumption that the quantity of money is constant." (Keynes J.M., 1973a, p.232n)Following this train of thinking, we deduce that it’s only afterwards that the decreased level of the rate of interest will stimulate investment, consumption and total income. The final result of an increase in the propensity to save will then depend on the ‘specific weight’ of each of these two effects.

Not coincidentally, Lange explicitly assumes in equation (3) – by drawing on Karl Marx's realization crisis – that consumption directly affects investment, as an excessive growth in saving (i.e. an excessive contraction of consumption, investment and total income) cannot be counter-balanced by the subsequent decrease in the rate of interest, as it destroys any incentive to invest, "at least in a capitalist economy where investment is done for profit" (Lange, 1938, p.23). He thus firmly rejects the (Neo)-Classical assumption that any abstinence from consumption implies automatically an increase in investment: according to him, such a direct relationship holds only until a certain limit (i.e. the optimum propensity to consume), beyond which the collapse of the demand for investment goods will drastically diminish investment itself. Therefore, the real issue becomes if and how it is possible to determine (and to maintain) such an optimum propensity to consume, given a market economy. Lange's opinion is definitely non-optimistic:

"In a society where the propensity to save is determined by the individuals, there are no forces at work that keep it automatically at its optimum, and it is well possible, as the under-consumption theorists maintain, that there is a tendency to exceed it." ( p.32)In other words, the result of Lange's analysis converges with (and radicalizes, as well) Keynes' pivotal idea, that is, the tendency towards a chronic under-consumption crisis.

Full paper is available here.

P.S. It is worth noting that Keynes himself was prompted to reflect that Lange's article "follows very closely and accurately my line of thought" (Keynes, 1973a) notwithstanding the analytical differences. Lange was, after all, standing on the same "side of the gulf," as he clearly rejected the notion that capitalism could be a "self-adjusting system" (Keynes, 1973b).

Subscribe to:

Posts (Atom)

Keynes’ denial of conflict: a reply to Professor Heise’s critique

Tom Palley reply to response about his paper on Keynes lack of understanding of class conflict. In many ways, this is how Tom discusses Ke...

-

"Where is Everybody?" The blog will continue here for announcements, messages and links to more substantive pieces. But those will...

-

There are Gold Bugs and there are Bitcoin Bugs. They all oppose fiat money (hate the Fed and other monetary authorities) and follow some s...

-

By Sergio Cesaratto (Guest Blogger) “The fact that individual countries no longer have their own currencies and central banks will put n...